Lendease Direct

Mortgage Investment Corporation

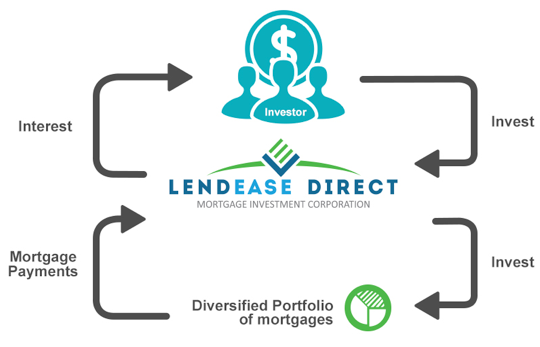

Investing with Lendease Direct MIC

LED MIC offers interest in the form of dividends at 8% per annum to an investor.

The investor purchases 50,000 shares of LendEase Direct at a par value of $1 per share.

The shareholder would be paid $4,000 in dividends ($50,000 x 8%).

- With a MIC (Mortgage Investment Corporation) your money is pooled into a giant fund along with all the investor’s money. It is then lent out to borrowers on first and second mortgages. I like the idea that my investment isn’t tied to one borrower on one property. The risk is spread out over several borrowers and properties.

- I trust and value the underwriting guidelines of Lendease and appreciate that the equity in the property is always maintained. Meaning that, depending on the deal, Lendease always keeps a minimum of 20% equity in a property, most times much more than that. On average there is about 35% equity left in the properties we lend on. From my own personal perspective, I try to consider what would cause me to lose money? From my personal perspective, I think a) a large number of our borrowers would have to walk away from their loans. b) Lendease would then have to be in a position where they couldn’t sell those properties in order to pay back the loan. From my perspective, for this to happen the real estate market across Canada would have to take a dip by at least 30% or more. I figure if this happens then all the other financial markets (and investments) will be down too.

- It’s a rate of return of up to 8% and this return doesn’t fluctuate with the financial markets. It’s simple math! I earn 8% because they are charging more than that on the mortgages they give. Plus I have the potential to earn an additional dividend if there are extra profits left in the company.

- All shares are of the same class. Meaning my shares have the same value as the President and as Joe Blow off the street. If anything did go sideways and Lendease needed to fold, I have comfort in knowing that all shareholders are paid out equally (not just the big guys at the top).

We are also hosting an info session webinar and would love to have you join us and hear more about Lendease Direct. Register for the upcoming webinar on February 7th at 8pm MST here https://zoom.us/webinar/register/WN_uloJQpzjRp-PwwZX2Qk0GA